In competitive Phoenix real estate market, comprehensive Phoenix AZ mobile home insurance quotes are vital for business owners to protect investments against physical damage, liability claims, and interruptions. Tailor coverage options to address regional risks like extreme heat, wildfires, storms, and natural disasters. Compare quotes from reputable providers, focusing on policy types (all-risk vs. named-peril) and details, while consulting professionals for competitive rates and peace of mind. Evaluate unique property vulnerabilities, adequate weather protection, value assessment, and optional coverages to secure best protection.

In Phoenix, AZ, safeguarding your investment in a mobile home is paramount. Understanding commercial building coverage plans is crucial for ensuring comprehensive protection against potential risks. This article guides you through the essentials of Phoenix AZ mobile home insurance, including key considerations and obtaining quotes that suit your needs. We’ll explore comparing plans to help you navigate this process effectively, securing peace of mind for your valuable property. Get ready to discover how to best protect your Phoenix mobile home with expert insights on insurance quotes.

- Understanding Commercial Building Coverage: What You Need to Know

- Phoenix AZ Mobile Home Insurance: Key Considerations and Quotes

- Comparing Plans: Strategies for Securing Comprehensive Protection

Understanding Commercial Building Coverage: What You Need to Know

In the dynamic real estate market of Phoenix, AZ, understanding your commercial building coverage is paramount for business owners. Commercial property insurance goes beyond basic home insurance, catering to the unique risks and needs of larger structures like office buildings, retail spaces, and industrial facilities. It’s a comprehensive plan that protects against physical damage, liability claims, and even business interruption, ensuring your investment remains safeguarded.

When considering Phoenix AZ mobile home insurance quotes, business owners should be aware of various coverage options tailored to their specific needs. From fire and theft protection to coverage for natural disasters prevalent in the region, such as severe storms and earthquakes, a well-crafted policy can offer peace of mind and financial security. It’s essential to review policy details carefully, understanding what’s covered, exclusions, and potential limitations to make an informed decision that aligns with your commercial goals.

Phoenix AZ Mobile Home Insurance: Key Considerations and Quotes

In Phoenix, AZ, securing the right Phoenix AZ mobile home insurance is paramount for owners to safeguard their investment and protect against potential risks. When exploring coverage options, several key considerations come into play. Firstly, understand the specific perils common in the region, such as extreme heat, wildfires, or unexpected storms, as these can impact the structural integrity of mobile homes. Secondly, review different policy types, including all-risk and named-peril coverages, to decide on the level of protection needed.

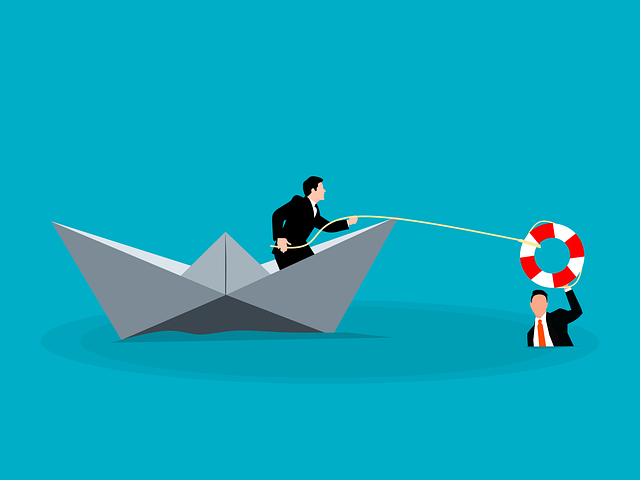

Obtaining Phoenix AZ mobile home insurance quotes from reputable providers allows owners to compare policies and pricing. Quotes should clearly outline coverage limits, deductibles, and exclusions to ensure they align with individual needs. It’s beneficial to consult professionals who can guide through the process, ensuring comprehensive protection at competitive rates for a peaceful mind.

Comparing Plans: Strategies for Securing Comprehensive Protection

When comparing property commercial building coverage plans, especially in competitive markets like Phoenix, AZ, it’s crucial to go beyond base coverage and strategize for comprehensive protection. Start by evaluating specific risks unique to your mobile home or commercial space—from structural vulnerabilities to potential environmental hazards. In Phoenix, extreme weather events can be a significant concern, so ensure your policy includes adequate coverage against storms, floods, or earthquakes.

Next, assess the value of your property and its contents. Consider options like replacement cost vs. actual cash value, and think about optional coverages like business interruption or extra expenses if you need to relocate temporarily due to insured damage. Don’t forget to request Phoenix, AZ mobile home insurance quotes from multiple providers to compare policies, pricing, and the range of services they offer, ensuring you secure the best protection for your investment.

When it comes to safeguarding your investment in a Phoenix, AZ mobile home, securing the right property commercial building coverage plan is paramount. By understanding the nuances of different policies and comparing quotes from reputable insurers, you can navigate this process with confidence. Remember that comprehensive protection includes not just structural damage but also liability coverage, ensuring you’re prepared for any unforeseen circumstances. With the right strategy in place, you’ll have peace of mind knowing your mobile home is protected against potential risks. Don’t forget to request Phoenix AZ mobile home insurance quotes from multiple providers to find the best fit for your needs and budget.