In competitive Phoenix, Arizona, where a diverse economy supports many self-employed individuals, Disability Income Insurance (DII) acts as a vital safety net. As employer-sponsored benefits are scarce, DII provides essential income protection during illness or injury, alleviating financial strain and enabling policyholders to focus on recovery. Customizable policy options cater to specific needs, offering peace of mind and financial stability for freelancers facing critical health challenges.

In today’s unpredictable world, protecting your financial future is paramount. For self-employed individuals in Phoenix, securing Disability Income Insurance (DII) can be a game-changer. This article delves into the significance of personal critical illness protection, specifically tailored for the unique needs of the self-employed. We explore why DII is essential and guide you through navigating various options to ensure financial security. Understanding these plans can help safeguard your livelihood and plan for a prosperous future in the vibrant Phoenix landscape.

- Understanding Disability Income Insurance for Self-Employed Individuals

- Why Personal Critical Illness Protection is Essential in Phoenix

- Navigating Options and Planning for Your Future

Understanding Disability Income Insurance for Self-Employed Individuals

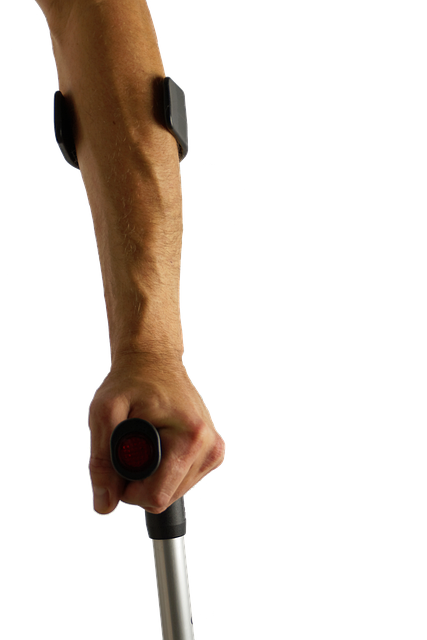

For self-employed individuals in Phoenix, Disability Income Insurance (DII) is a crucial safety net to protect against financial instability in case of illness or injury that renders them unable to work. Unlike traditional employment, self-employment offers limited access to employer-sponsored benefits like disability coverage, making it essential for freelancers and business owners to secure private insurance. DII provides income replacement, ensuring individuals can maintain their standard of living during recovery, without the burden of mounting medical expenses.

In Phoenix, where the competitive business landscape demands adaptability and resilience, having Disability Income Insurance offers peace of mind. It enables self-employed individuals to focus on healing and return to work when ready, knowing their financial obligations are met. With various policy options tailored to specific needs, Phoenix residents can customize coverage amounts, duration, and waiting periods to align with their entrepreneurial journeys.

Why Personal Critical Illness Protection is Essential in Phoenix

In the vibrant and bustling city of Phoenix, Arizona, personal critical illness protection is more than just a consideration—it’s an essential safety net for individuals and families navigating life’s uncertainties. With a diverse economy and a thriving self-employed community, many Phoenix residents face unique challenges when it comes to financial security. Disability Income Insurance For Self Employed In Phoenix plays a pivotal role in safeguarding their livelihoods during unforeseen events like critical illnesses or injuries that may render them unable to work.

Without adequate protection, the self-employed and small business owners among us risk facing significant financial strain. Personal critical illness coverage steps in to provide a much-needed financial cushion, offering peace of mind and enabling individuals to focus on recovery rather than monetary worries. This proactive approach ensures that Phoenix residents can continue to meet their financial obligations while they take time off to recuperate from critical health issues.

Navigating Options and Planning for Your Future

Navigating the world of personal critical illness protection can seem daunting, especially for self-employed individuals in Phoenix who rely on their health and income to sustain their livelihood. One crucial aspect is considering Disability Income Insurance, which provides financial security when an individual becomes unable to work due to a medical condition. This type of coverage is invaluable for freelancers and entrepreneurs who may not have access to traditional employer-sponsored benefits.

When planning for your future, research different insurance providers offering disability income protection tailored to self-employed individuals. Compare policies based on coverage amounts, waiting periods, and duration. Additionally, ensure that the plan aligns with your specific needs, considering factors like your age, health status, and financial obligations. A well-planned strategy will offer peace of mind, knowing you’re prepared for any unexpected health challenges while maintaining your financial stability.

Personal critical illness protection is a vital tool for self-employed individuals in Phoenix, offering financial security during unexpected health challenges. By understanding disability income insurance options tailored for the self-employed, you can navigate your future with peace of mind. With the right coverage, you’ll be prepared to face potential disabilities and their associated costs, ensuring your financial stability remains intact. Embrace proactive planning by exploring these essential protection measures, as they could prove invaluable in securing your well-being and that of your loved ones.