Identity theft is a growing concern in Phoenix, Arizona due to cybercriminal activity targeting personal data. Victims face severe financial and emotional distress from unauthorized credit card charges, loans, or bank account openings. To combat this, proactive measures like credit report monitoring, secure online practices, and vigilance are crucial. Early detection through credit repair services tailored for Phoenix's risk factors minimizes damage and prevents long-term harm. When choosing the best identity theft protection in Phoenix, consider comprehensive coverage, reputable providers, and tailored features such as credit monitoring, legal support, and score tracking.

Identity theft is a growing concern, leaving many victims struggling with damaged credit. If you’re in Phoenix, Arizona, understanding your options for recovery is crucial. This article guides you through the process of repairing stolen identity and highlights the critical role played by specialized credit repair services in the region. We’ll explore how these professionals assist in rebuilding credit, suggest steps to choose the best identity theft protection plans tailored to your needs, and ensure you’re equipped to safeguard your financial future in Phoenix, Arizona.

- Understanding Identity Theft and Its Impact

- The Role of Credit Repair Services in Phoenix, Arizona

- Choosing the Best Identity Theft Protection for Your Needs

Understanding Identity Theft and Its Impact

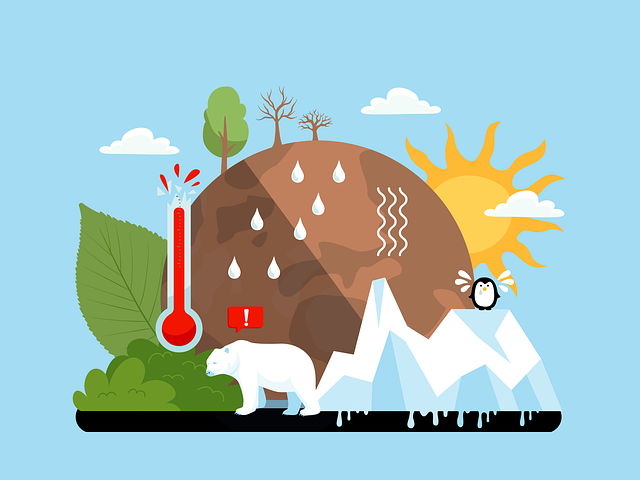

Identity theft is a serious crime that can have devastating financial and emotional consequences for victims. It occurs when someone uses your personal information, such as your name, Social Security number, or credit card details, without your permission to commit fraud or other criminal activities. In today’s digital age, with countless data breaches and online scams, the risk of identity theft is ever-present. Phoenix, Arizona, residents should be particularly vigilant given the growing sophistication of cybercriminals targeting personal information.

The impact of identity theft can be far-reaching. Stolen personal details can lead to unauthorized charges on credit cards, loans taken out in your name, or even fraudulently opened bank accounts. Victims may find themselves with ruined credit scores and a lengthy process ahead to restore their financial standing. The best identity theft protection in Phoenix, Arizona, involves proactive measures like monitoring credit reports, using secure online practices, and being cautious of suspicious activities on bank statements. Early detection is key to minimizing damage and preventing long-term harm from this insidious crime.

The Role of Credit Repair Services in Phoenix, Arizona

In the vibrant city of Phoenix, Arizona, individuals seeking solace from identity theft face a unique challenge. The best identity theft protection is often crucial in reclaiming one’s financial standing. Credit repair services play a pivotal role here, offering specialized assistance to navigate the complex landscape of restoring creditworthiness. These services provide a comprehensive solution for those who find themselves entangled in the aftermath of identity theft, helping them to rebuild and protect their financial reputation.

Phoenix residents can benefit from various reputable credit repair companies that employ strategic methods to dispute fraudulent activities, correct errors in credit reports, and educate clients on preventive measures. With expert guidance, individuals can gain control over their financial future, ensuring the protection of their personal information and maintaining a robust credit profile.

Choosing the Best Identity Theft Protection for Your Needs

When selecting the best identity theft protection for your needs in Phoenix, Arizona, it’s crucial to evaluate several factors. Firstly, consider the level of coverage offered by different plans. Some basic packages may only monitor your credit reports, while comprehensive options can protect against a wide range of identity theft activities, including financial and personal data breaches. Additionally, look into the reputation of the provider; research their customer reviews and ratings to ensure they offer reliable and efficient services.

In terms of features, choose a plan that aligns with your specific requirements. This may include credit monitoring, identity restoration assistance, legal defense in case of theft, and even insurance for associated costs. Some providers also offer score tracking and alerts for any changes in your financial standing. Compare these aspects to find the best balance between cost and protection, ensuring you get the most suitable best identity theft protection for your Phoenix home.

In light of the pervasive threat of identity theft, residents of Phoenix, Arizona, now have access to specialized credit repair services that not only help recover from financial damage but also offer tailored best identity theft protection plans. By understanding the impact of this crime and leveraging professional resources, individuals can safeguard their financial future and enjoy greater peace of mind. When choosing the right identity theft protection for your needs, look for comprehensive coverage, easy access to support, and regular monitoring – all key factors in ensuring a secure digital landscape.