In Arizona, strict identity theft protection policies are enforced, making identity theft insurance crucial for safeguarding personal information and preventing significant financial losses. This insurance covers legal fees, credit monitoring, and identity restoration costs. It's beneficial for small business owners, frequent online transaction users, and anyone concerned about digital security. Top-rated policies offer specialized recovery services, proactive monitoring, and legal support. By combining strong security practices with identity theft insurance Arizona, individuals can reduce the risk of identity theft and protect their digital footprint.

In today’s digital age, protecting your personal information is paramount. Identity theft insurance emerges as a powerful safeguard against this growing threat, offering peace of mind in Arizona’s regulated landscape. This article navigates the intricacies of identity theft insurance, shedding light on its benefits and Arizona-specific laws. From understanding coverage to practical prevention tips, we empower you to secure your digital presence effectively. Discover how top-rated policies can shield you from financial loss and personal inconvenience, ensuring a robust defense against identity theft.

- Understanding Identity Theft Insurance: What It Covers and Who Needs It (Focus on Arizona laws and regulations related to identity theft)

- Key Features and Benefits of Top-Rated Identity Theft Insurance Policies in Arizona

- Safeguarding Your Digital Presence: Practical Tips for Preventing Identity Theft Alongside Having Insurance Coverage

Understanding Identity Theft Insurance: What It Covers and Who Needs It (Focus on Arizona laws and regulations related to identity theft)

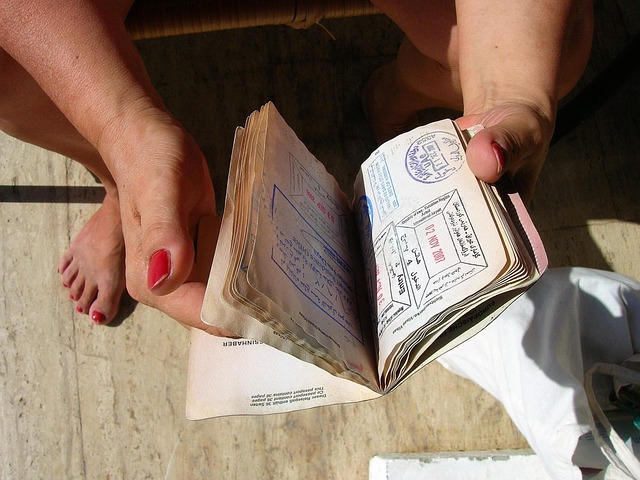

In Arizona, understanding identity theft insurance is crucial for protecting personal information. This type of insurance provides financial protection against the costs associated with identity theft, such as legal fees, credit monitoring services, and restoration of identity. It’s not just for those who have experienced a breach; it’s also beneficial for anyone looking to safeguard their sensitive data in an increasingly digital world.

Arizona laws and regulations require certain businesses to offer this coverage due to the state’s strict identity theft protection policies. Individuals who fall victim to identity theft may face significant financial losses, so having insurance can help mitigate these risks. It covers various incidents, including unauthorized use of personal information for financial gain, fraud, or other malicious purposes. Those who need it include small business owners, individuals with high-risk factors (like frequent online transactions), and anyone concerned about their digital security in Arizona.

Key Features and Benefits of Top-Rated Identity Theft Insurance Policies in Arizona

In today’s digital era, where personal information is readily accessible, having robust identity theft insurance Arizona is more crucial than ever. Top-rated policies offer a comprehensive suite of features designed to protect individuals from the financial and emotional repercussions of identity theft. One of the key benefits is access to specialized recovery services. These services provide expert guidance in navigating the complex process of restoring one’s identity, including assistance with credit reports, legal issues, and fraudulent accounts.

Additionally, these policies often include monitoring services that proactively scan for any suspicious activity linked to an individual’s personal information. If such activity is detected, policyholders are promptly alerted, enabling them to take immediate action to prevent further damage. This proactive approach is a game-changer in the fight against identity theft, ensuring individuals stay one step ahead of potential criminals.

Safeguarding Your Digital Presence: Practical Tips for Preventing Identity Theft Alongside Having Insurance Coverage

In today’s digital era, our online presence holds vast amounts of personal information, making it a prime target for identity thieves. Safeguarding this data is crucial to prevent fraud and financial loss. One effective strategy is to adopt robust security practices when managing your digital footprint. Begin by using strong, unique passwords for each account; consider employing a password manager to keep track. Enable two-factor authentication (2FA) wherever possible, adding an extra layer of security beyond passwords. Regularly update software and operating systems to patch vulnerabilities exploited by hackers.

Additionally, consider obtaining identity theft insurance in Arizona as a proactive measure. This coverage can provide peace of mind and financial protection if you fall victim to identity fraud. Insurance plans often include services like credit monitoring, legal defense, and reimbursement for certain expenses incurred due to identity theft. While these precautions cannot guarantee complete immunity, they significantly reduce the risk and impact of potential identity theft, ensuring your digital presence remains secure.

Protecting your digital identity is an essential aspect of modern life, especially with the ever-evolving landscape of online security threats. In Arizona, where identity theft insurance is becoming increasingly relevant, understanding the coverage options and practical steps to prevent such crimes is crucial. By investing in top-rated identity theft insurance policies and implementing digital safety measures, individuals can gain peace of mind knowing their personal information is safeguarded. Remember, staying proactive and informed about these safeguards is key to navigating the digital world securely.