AI tokenization revolutionizes mobile home insurance by enhancing data security and unlocking valuable insights through advanced risk analysis engines. These tools process historical claims, demographics, and environmental factors to create comprehensive risk profiles, enabling precise policy pricing and tailored coverage for improved risk management. AI-driven engines adapt with new data, ensuring dynamic modeling and effective loss mitigation, ultimately benefiting both insurers and mobile home owners.

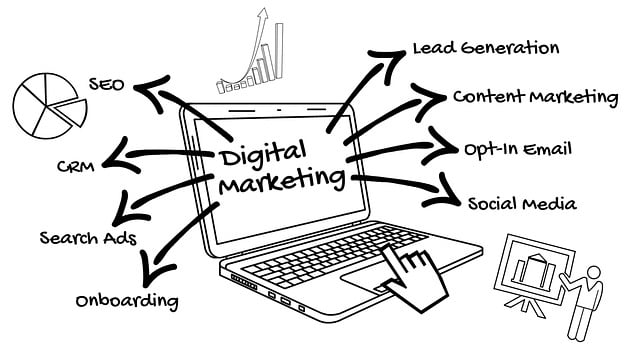

The insurance industry is undergoing a transformative shift with the advent of AI, particularly in assessing and managing risks for mobile homes. This article delves into the innovative aspects of AI tokenization, enhancing data security while unlocking valuable insights for insurers. We explore how risk analysis engines leverage machine learning to accurately model potential hazards. Additionally, we highlight AI’s role in streamlining claims processing, demonstrating its pivotal function in modern home insurance through efficient risk modeling.

- AI Tokenization: Unlocking Data Security for Insurance

- Risk Analysis Engines: Powering Accurate Mobile Home Insuring

- Efficient Claims Processing: AI's Role in Risk Modeling

AI Tokenization: Unlocking Data Security for Insurance

AI tokenization is transforming the insurance industry by enhancing data security and unlocking valuable insights for risk modeling. This innovative technology enables the breakdown of sensitive information into secure tokens, ensuring that personal details are protected while still allowing for meaningful analysis. By leveraging AI tokenization, mobile homes insurance providers can access a richer dataset, enabling them to develop more accurate risk assessment models.

AI tokenization risk analysis engines can process vast amounts of data, including historical claims, policyholder demographics, and environmental factors, to create comprehensive profiles. This granular understanding of risks allows insurers to tailor policies, set premiums, and manage portfolios more efficiently. With enhanced data security and advanced analytics capabilities, AI tokenization is a game-changer in the mobile homes insurance space, fostering transparency, fairness, and improved risk management practices.

Risk Analysis Engines: Powering Accurate Mobile Home Insuring

Risk Analysis Engines, powered by advanced AI and tokenization techniques, are revolutionizing the way mobile home insurance is underwritten. These cutting-edge tools meticulously analyze vast datasets to identify patterns and predict potential risks associated with insuring mobile homes. By processing historical claims data, geographic information, and structural details, these engines can accurately assess the likelihood of damage or loss.

The integration of AI tokenization enhances risk analysis by breaking down complex data into meaningful tokens, allowing for a deeper understanding of various factors influencing insurance claims. This enables insurers to make more informed decisions, set appropriate premiums, and customize policies based on individual risks. As a result, mobile home owners benefit from tailored coverage that aligns with their specific needs and minimizes financial exposure.

Efficient Claims Processing: AI's Role in Risk Modeling

Artificial Intelligence (AI) is transforming claims processing in mobile homes insurance, offering faster and more accurate results. AI tokenization risk analysis engines can efficiently sift through vast amounts of data, from historical claims records to environmental factors, to identify patterns and predict potential risks. This capability streamlines the initial assessment stage, enabling underwriters to make informed decisions promptly.

Through its analytical prowess, AI enhances the overall risk modeling process. By continuously learning from new data inputs, these engines can adapt to evolving trends in mobile homes insurance claims. This adaptability ensures that risk assessments remain dynamic and up-to-date, ultimately leading to more effective pricing strategies and improved loss mitigation efforts.

AI tokenization and advanced risk analysis engines are transforming mobile homes insurance. By securely unlocking and analyzing vast datasets, these technologies enable more precise risk modeling and efficient claims processing. This innovative approach not only enhances insurance accuracy but also brings significant benefits to both insurers and policyholders, promising a safer and more streamlined future for the industry.