In competitive Phoenix, Arizona, understanding apartment insurance's structural damage coverage is crucial for tenants and landlords. This protects against significant repairs or rebuilding due to unforeseen events like earthquakes, storms, or fires. Residents should review policy fine print, including deductibles, limits, and exclusions, to make informed decisions about their protection. Apartment insurance plans in areas prone to natural disasters offer peace of mind and financial assistance for necessary repairs or reconstruction, ensuring tenants can quickly restore their homes. Efficiently navigating the claims process involves documenting damage with photos and videos, keeping repair estimates, reviewing policies, and promptly contacting insurers to report incidents.

In the vibrant, bustling city of Phoenix, Arizona, understanding your apartment insurance is crucial, especially regarding property structural damage coverage. This guide delves into the key policy offerings and benefits designed to protect residents from unforeseen structural issues. From foundation flaws to roof repairs, we explore how to navigate claims effectively. Learn about the essential steps to maximize your compensation and ensure peace of mind in case of structural damage, focusing on apartment insurance in Phoenix, Arizona.

- Understanding Property Structural Damage Coverage in Apartment Insurance Phoenix Arizona

- Key Policy Offerings and Benefits for Residents

- How to Navigate and Maximize Your Claims in Case of Structural Damage

Understanding Property Structural Damage Coverage in Apartment Insurance Phoenix Arizona

In the competitive apartment insurance market in Phoenix, Arizona, understanding property structural damage coverage is paramount for tenants and landlords alike. This type of coverage protects against significant repairs or complete rebuilding due to unforeseen events like earthquakes, storms, or fires. It’s crucial to review policy fine print to grasp what’s covered, including both exterior and interior structural elements.

Apartment insurance in Phoenix often includes specific provisions for structural damage, ensuring financial security during unexpected events that can leave buildings severely damaged. Tenants should be aware of deductibles, coverage limits, and any exclusions detailed in their policies. By understanding these aspects, residents can make informed decisions about their protection and choose the apartment insurance plan best suited to their needs in Phoenix, Arizona.

Key Policy Offerings and Benefits for Residents

When it comes to protecting your home, especially in areas prone to natural disasters like Phoenix, Arizona, having the right property structural damage policy is paramount. Apartment insurance in Phoenix offers a range of key policy offerings designed to benefit residents. These policies typically cover significant structural damages caused by events such as fires, floods, earthquakes, and storms, ensuring that tenants can rebuild or repair their homes without facing financial backlogs.

One of the primary benefits for residents is peace of mind. Knowing that your apartment insurance Phoenix Arizona provides comprehensive protection against structural damage allows you to focus on daily life without worrying about potential repairs or reconstruction costs. Additionally, these policies often include provisions for replacement costs, which can be a significant aid in restoring your home to its original state after a damaging event.

How to Navigate and Maximize Your Claims in Case of Structural Damage

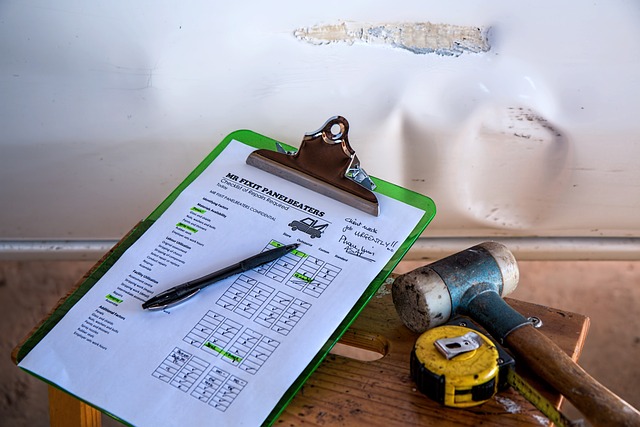

When your apartment or home in Phoenix, Arizona faces structural damage due to unforeseen events like storms, earthquakes, or accidents, navigating the claims process with your insurance provider is crucial. The first step is to thoroughly document the damage by taking photos and videos of the affected areas. This visual evidence will be invaluable when submitting your claim. Additionally, keep detailed records of repair estimates from multiple contractors to ensure you receive fair compensation for necessary repairs.

Next, review your apartment insurance policy carefully, paying close attention to the coverage limits and exclusions. If you have comprehensive or all-risk coverage, you’re typically protected against various structural damage causes. Contact your insurance provider promptly to report the incident and initiate the claims process. Be prepared to provide them with precise information about the damage and any relevant details that might influence the claim, such as when the damage was first noticed and if there were any previous repairs in the area. Effective communication will expedite the process, ensuring you maximize your claim’s potential outcome.

When it comes to apartment insurance in Phoenix, Arizona, understanding your property structural damage policy is key to ensuring peace of mind. By knowing the coverage offerings and benefits available, residents can effectively navigate claims processes and maximize their protection against structural damage. With the right knowledge, you can rest assured that your home is secure, and any potential issues will be addressed promptly, allowing you to focus on what truly matters.